Post 23: Main Street vs Wall Street / Macro Modeling

We have been in the trenches trying to produce effective macro models across a number of different markets and strategies. We are deep in the J-Curve right now and hope to see the light soon.

Main Street vs Wall Street: The performance of the market is not conditional on the state of the economy, but the state of the economy can be conditional on the whims of the market.

Wall Street - Trust fund, 6’5, blue eyes

$10,000 invested in NVDA at it’s IPO in 1999 would now be worth ~$59MM, it is now larger than the entirety of the UK and French markets. The S&P is now up ~34% since its last bottom in Oct 2023, tripling its normal expected annualized returns in 8 months. Wall Street and our economy (all things considered) appear to be in okay shape. Now, there are plenty of caveats one could argue - but lets ignore those for now in lieu of the fact that the S&P continues to rip to all time highs. When rates do eventually come down (be that late 2024 & 2025 or 2026) we would expect to see equities and bonds in another huge rally, further benefiting Wall Street and as a result, the retirement portfolios of Main Street. However, a 401k does not buy groceries for anyone under 65. All said the market is truly having a historic run, the bears have retreated for the summer and there seems to be little reason for them to emerge for the remainder of the year.

The dollar has been on a fantastic run along with US equities. This places a burden on on reliant importers of energy. However, it has yet to harm Japan significantly as equities have ripped this year. There are plenty of notes that speak to further upside in the US. There remains a strong home country bias in foreign markets, will large underweights to US equity. This could mean dollars are waiting to rush in. There is still a huge amount of dry powder across private markets, and massive cash balances in public markets. All of this earning ~5% returns in risk free fixed income. These are dollars that could swoop in on a relative market decline which would help to support prices creating a floor where this liquidity would get put to work. As rates decline the likelihood of these dollars flowing into the economy increases as their opportunity costs change. Everything points to Wall Street being in sound shape. Main Street tells a different story.

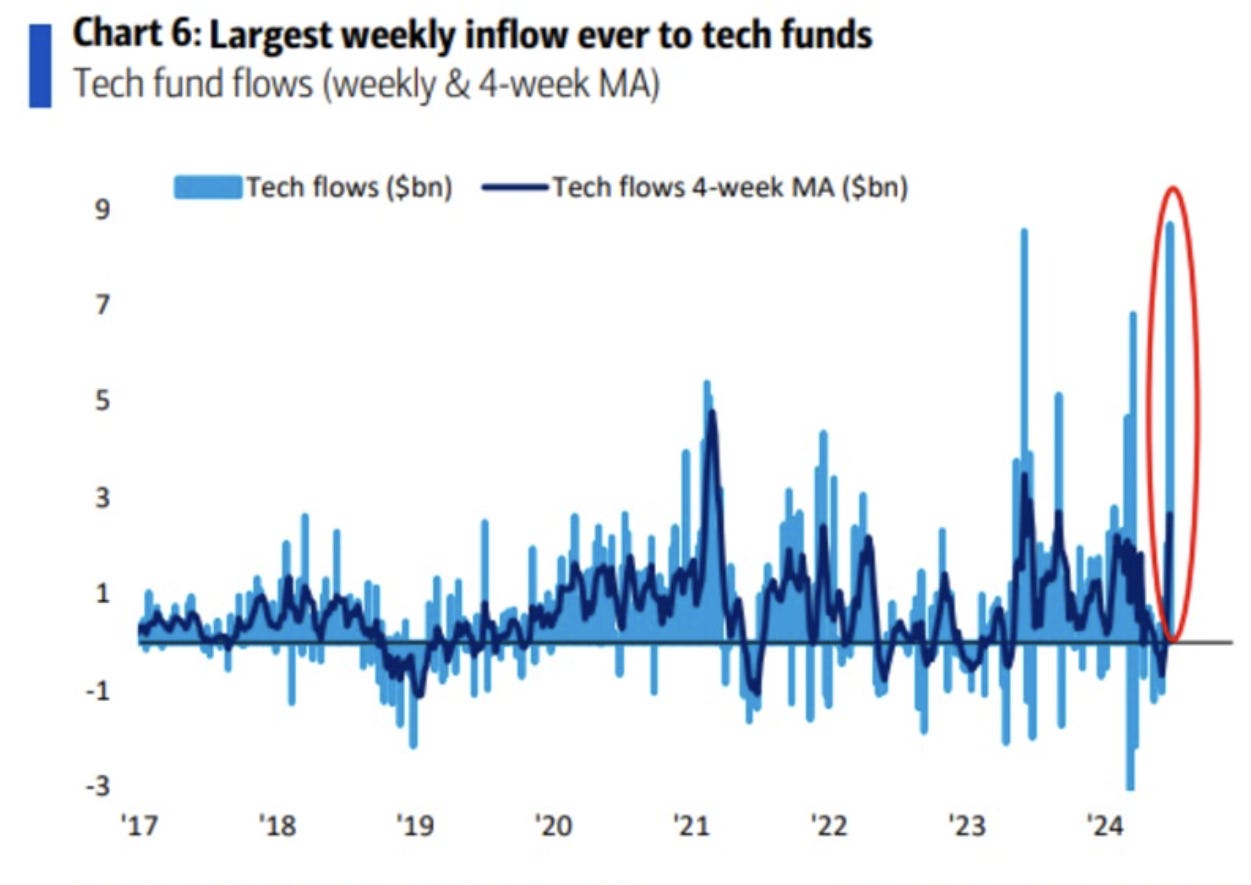

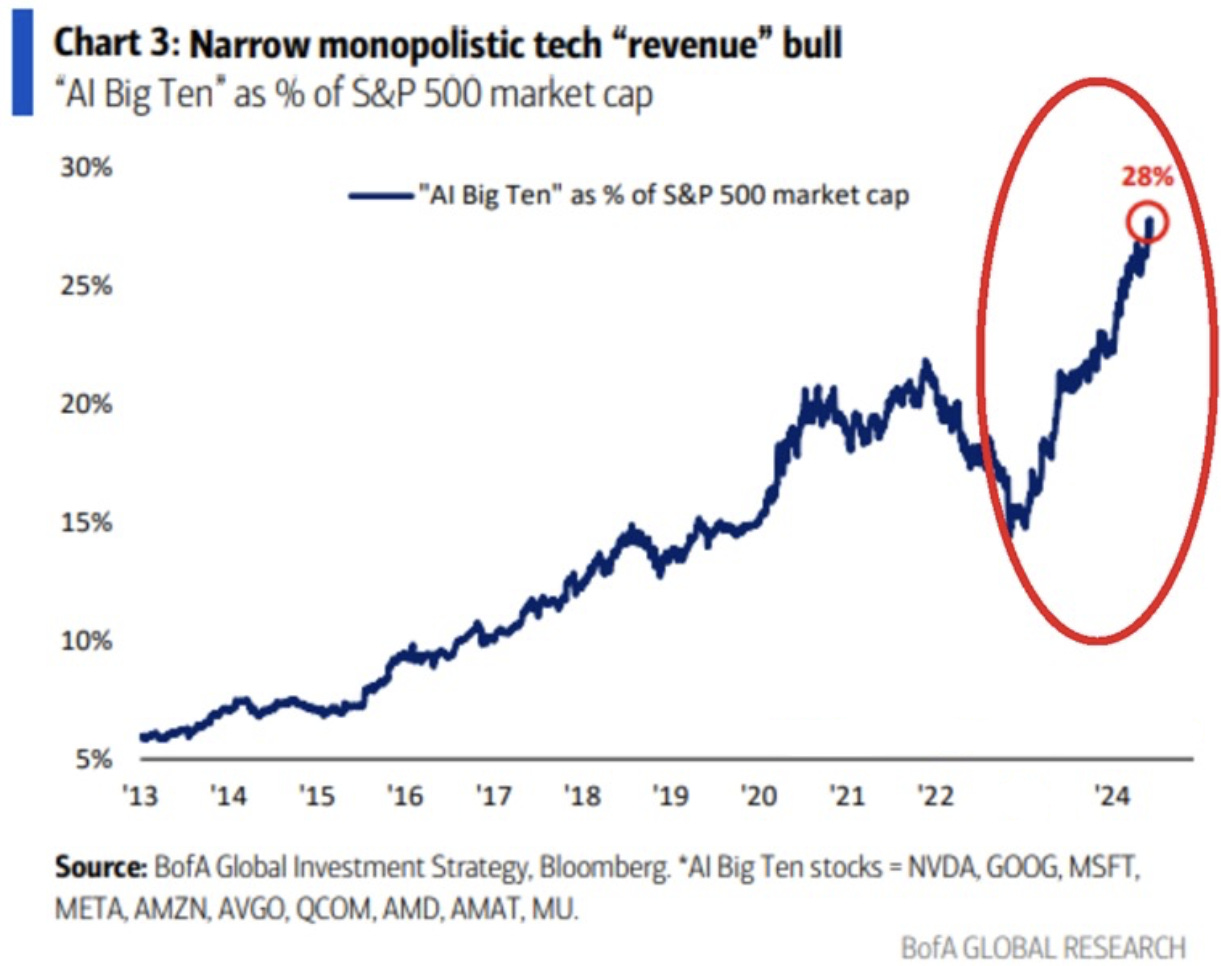

Wall Street continues to see massive inflows further adding to the AI momentum, its not just any tech that’s seeing out performance, its a select few that truly control 28% of the market.

Main Street - the every man.

Personal savings are now below 2016 levels and continue to decline. At the same time, consumer sentiment is improving. People are viewing the stock market as an entity reflective of the broader economy, this is often correct. However, there is clearly a divergence between the two. The American consumer is unable to satiate their appetite to consume, this appetite appears to have developed sentience faster than any LLM. The largest company in the world (depending on the day) NVDA, only has $60B in revenue on its 3.2T in market cap, compare that to a frothy Microsoft, which has revenues of $200B against 3.3T. Both have a massive AI premium.

At the same time consumption expenditures are roaring higher, while real expenditures are moderately increasing it is unlikely that the avg consumer has seen wage gains in check with inflation. Meaning the real cost of living continues to increase for many.

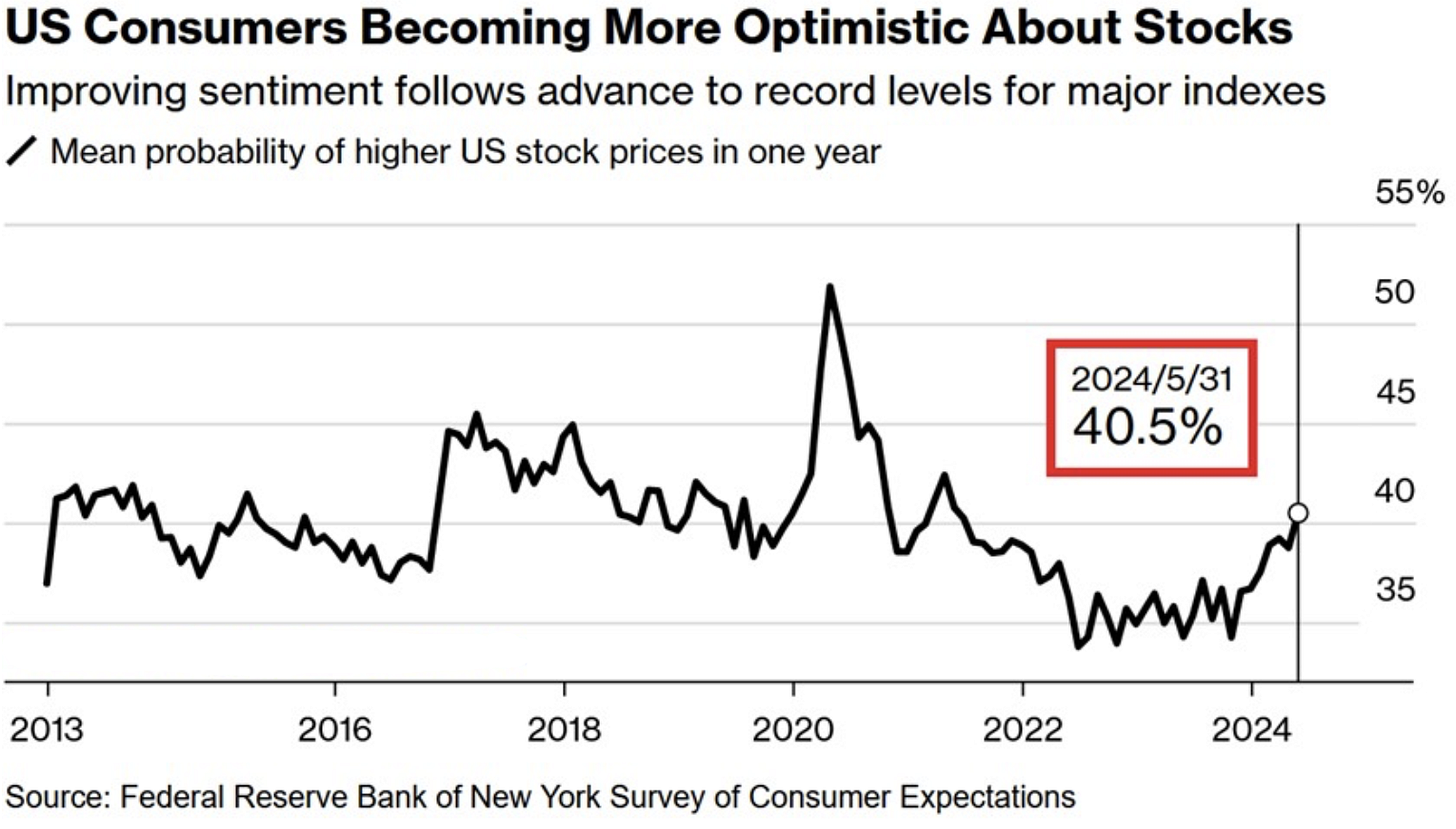

Its not just Consumer Sentiment which has been strong, consumers are ecstatic about the future of stocks. At all time highs and consumers couldn’t be happier. Not anywhere near the bubble craze of 2020 covid-crypto hype but the zeitgeist is on its way.

Delinquency rates are up across consumer and credit card loans, from ~1.5% to over 3% as of Q1 2024. This returns them to their pre-covid levels. The concern here shouldn’t be the 100% increase in delinquency rates but that consumers truly are running out of cash, excess savings are drying up.

2024 marks a huge election year. Where a record number of people “hate both candidates” , usual for American politics but worse than normal. Both candidates will do anything to keep the gravy train rolling, meaning increased government spending and a booming deficit. This will stimulate the economy further, (much of our growth has been driven by the increased deficit), but is unlikely to truly support the real economy underlying the financial markets. Whomever wins I think we see markets rip after a period of uncertainty. We may see variations in foreign trade policy in the two, which could further fuel inflation if tariffs are implemented.

Either way, all I would like to see is a fair shake for Main Street when the dust settles. By no means have they received the worst end of it over the last three decades, the general American populous has flourished. But the systems, institutions, and ideas which were instrumental in that growth are floundering. I am not sure if deficit spending and AI can hide those cracks for another decade.

Macro Modeling: Quant Assisted Discretionary Macro

I wanted to write a short post to describe some of the progress we have made and some of the challenges we have run into. We have been using code to significantly leverage our capabilities. Without being able to automate or code these processes they become monumental challenges. There are a number of resources online for this and producing the code has never been easier, we are in the age of LLMs that are adept at producing rules based code. We are discretionary macro traders who are wading into deeper waters, and finding a new avenue of research and developing our practice to become better at what we do. So far we have been able to build a number of models across markets as proof of concept and are now working towards a proprietary process which will allow us to move quickly on global ideas. One of our founders has name our process “Quant Assisted Discretionary” we believe we will have a foundational model in the next two months. If you have any experience in building models, or are interested in learning more please reach out to us. We would love to learn more from the community. Right now we are integrating macro data across a number of sources and working through determining the appropriate models for each market, we have proof of concept and are now working to refine the dataset further to improve accuracy and predictability.

Best,

Luke